Understanding Digital Currencies

and Cryptocurrencies

See also: Assessing Internet Information

Digital currencies are currencies (or money systems) that are only available electronically or digitally. They can therefore only be accessed via computers, including smartphones, and have no physical existence. Perhaps the best-known digital currency is Bitcoin, but there are many more.

Digital currencies have many advantages, but also some disadvantages. However, they are now becoming much more mainstream. For example, the Bank of England has announced that it is considering establishing a digital currency. It is therefore worth understanding a bit more about how digital currencies work, and especially where things might go wrong.

Types of Digital Currency

There are three main types of digital currency.

1. Cryptocurrencies

Cryptocurrencies use cryptography or coding to secure and verify transactions

This means that they are created using complex bits of computer code. More complex code is also used to record and verify transactions. For example, Bitcoin is the best known cryptocurrency. It is ‘mined’ by individuals or organisations solving complex computer puzzles, which get harder as more Bitcoin are mined. Each transaction is recorded through a system called blockchain. This records all transactions and holds those records across a network of computers owned and managed by individuals, rather than a central system. Each user therefore contributes to the blockchain, meaning that records cannot be falsified.

Bitcoin and other cryptocurrencies are therefore described as decentralised, because they are not controlled by central banks or governments. Indeed, many cryptocurrencies were created precisely to avoid this kind of control.

2. Virtual currencies

Virtual currencies are unregulated digital currencies that are created and controlled by developers or algorithms following a clear set of rules.

These types of currencies are interesting because they extend the concept of currency beyond the simple ‘buy and sell’. Instead, they transfer value. For example, a video game token may give you an extra life, or more power, but does not have a direct cash value. You could also argue that systems like Hong Kong’s Octopus card, and Transport for London’s Oyster card are virtual currencies, because they allow users to hold value on a piece of plastic, including both travelcards and a cash equivalent that can be used to pay for journeys.

3. Central bank digital currencies

Central bank digital currencies are regulated and issued by the central banks of particular countries.

They can replace or supplement standard currency. The central banks of several countries have announced that they are considering issuing a digital currency, including Sweden and the UK. These digital currencies are therefore completely centralised: the total opposite of most cryptocurrencies.

These digital currencies are therefore likely to be much less volatile than many other digital currencies, because they are backed by a central bank. Investors are likely to have the same faith in them as in the physical currency—which of course may be affected by government actions.

Digital currency is not the same as cryptocurrency

Remember: all cryptocurrencies are digital currencies. However, not all digital currencies are cryptocurrencies.

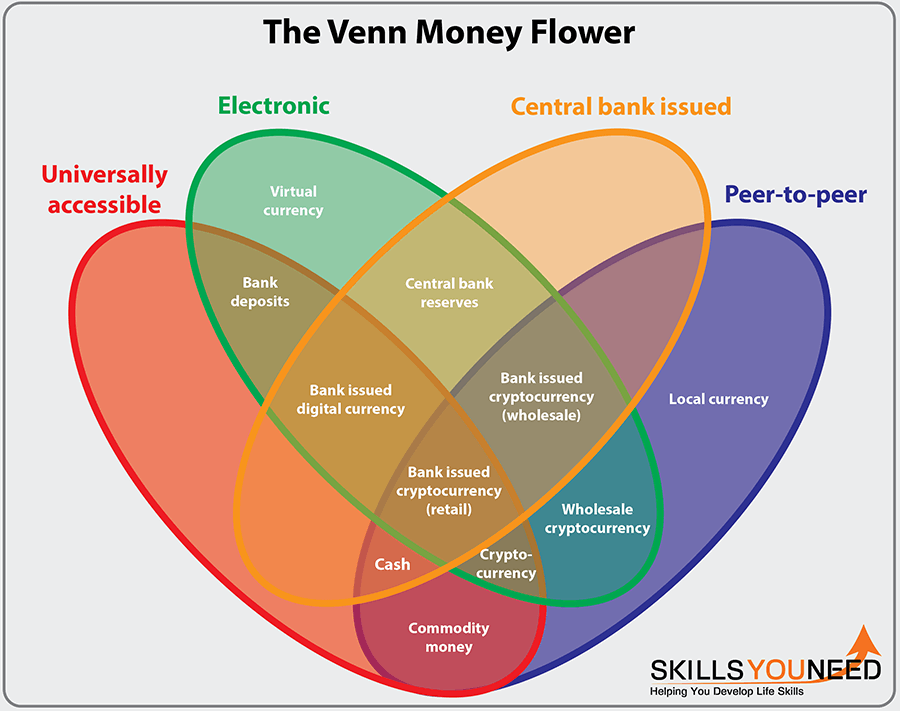

The figure below shows different types of currency, and how they fit together into a taxonomy including electronic (digital) currencies, and physical money.

Adapted from The Bank for International Settlements

Advantages of Digital Currencies

Digital currencies have a number of advantages. These include:

Fast transfer and transaction times. Transactions do not need an intermediary, so can be much faster than transfers of physical money provided that users are in the same network.

Transparency of process. As well as being fast, the electronic transfer also provides a clear record of every transaction. Whether that is via a bank’s systems, or using blockchain, the transactions are visible.

Reduced costs of transfer. By making transactions and transfers more direct and faster, digital currencies can reduce the number of intermediaries, and therefore make transactions cheaper.

There are no physical manufacturing requirements. Unlike physical money, you do not need to manufacture coins or notes, or worry about them being damaged in circulation. However, there is still a cost associated with mining cryptocurrencies, which is often overlooked (see box below).

Disadvantages of Digital Currencies

Speed of transactions is an obvious advantage, but digital currencies also have a number of important drawbacks, including:

They still need storing and processing capacity. You may not need bank vaults to hold digital currencies, but they still need storage—and that means computer space. This is not without cost, including in energy terms (see box).

Bitcoin’s ‘dirty secret’

You may think that digital currencies are cost-free to produce. However, this is not true, especially for cryptocurrencies.

Bitcoin’s ‘dirty secret’ is that mining it takes an enormous amount of computer power, because it can only be done by solving increasingly complex computer problems. That means that it uses a huge amount of energy. Indeed, some estimates suggest that mining Bitcoin uses as much energy each day as a small country.

Some proponents of Bitcoin have tried to argue that most of this energy is likely to be renewable. However, this argument does not stack up, because much Bitcoin mining takes place in China, where the economy is heavily dependent on coal-fired power.

It is, therefore, possible that cryptocurrencies are quite literally costing us the earth.

Digital currencies are not always secure. Just as physical currencies are vulnerable to forgers, digital currencies are vulnerable to hackers. Hackers may steal currency from digital wallets, or go direct to source, changing the protocol or algorithm, and affecting the value. Nobody has really managed to completely solve this problem yet—but then, preventing forgery of physical currencies is also still an ongoing process.

Digital currencies can be very volatile. All currency trading depends on investor confidence. However, it is much harder to have confidence in a digital currency, especially if you do not know its provenance. The history of digital currencies has shown some big swings in value in very short periods of time.

A final thought

Not all digital currencies are equal.

Different forms of digital currency have different characteristics. For example, cryptocurrencies are decentralised, and central bank digital currencies are centralised. There is also considerable variation even within categories. For example, different cryptocurrencies may have very different characteristics.

This means that they may also have different disadvantages and advantages. Some types may overcome the disadvantages of other types, but will have other advantages of their own. For example, few other forms of cryptocurrency have achieved the level of security of Bitcoin—but the high level of computing power required for Bitcoin is a serious disadvantage.

The development of digital currencies is therefore very much an ongoing process. It is worth staying up to speed on it.